Rule #1:

“you will never learn to swim without putting your genitals in the water.”

Why this read could potentially change your life for the better? I love long trips and I believe great personal finance is the key to make them happen.

Nice to meet you, I am an investor and a former finance professional, not the usual random idiot who writes about stuff he doesn’t know.

Through the years I grew sick of the filthy methods used by traditional banks, online gurus and the overall rotting of this industry. Luckily times have changed and now there are tools to manage your finances with little or no intervention from other people.

By now I have traded and managed assets myself for years and after reaping the benefits of it I shared these tips with my closest friends. More and more acquaintances were seeking advice so I have written a pdf document. 1 year later I have decided to turn it into this FREE guide.

Yes! No affiliates. Goodbye ads, pop-ups and cookies. No one trying to sell you something. I just want you to have a taste freedom!

So… get ready, take notes and when something gets unclear, write me a comment and I will try to simplify or delve more in depth… but most of all, follow the action steps! Table of Contents

Why should I invest?

To harness the benefits of compound interest and protect yourself from inflation.

Anyways, you are already investing but you are not aware of it. Holding any currency such the US Dollar is a form of investment called fiat currency. It tends to depreciate over time of about 2% per year in terms of purchasing power.

This 2% is called inflation and is decided and set by central banks, less than 2% is not desirable. Lately this amount has been significantly higher but you cannot postpone the inevitable; just consider that in history no currency has ever survived inflation.

According to a strange and convoluted process (see Phillips curve to learn more): if there is low or non-existent inflation, the number of unemployed raises. 2% is a fair balance that limits unemployment. To put it simply, your money is programmed to become worthless over time.

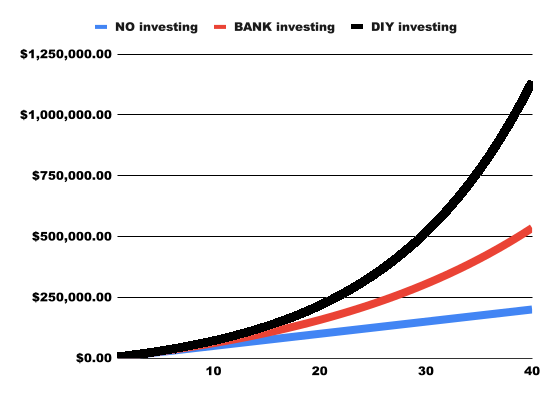

Inflation is only one of the reasons, the other one is compound interest. Imagine 3 people who save $5,000.00 every year for 40 years,

- Tobias puts the money in the bank account without investing (blue line).

- Jason invests through a bank (red line).

- Beth invests on her own (black line). Read further to learn how.

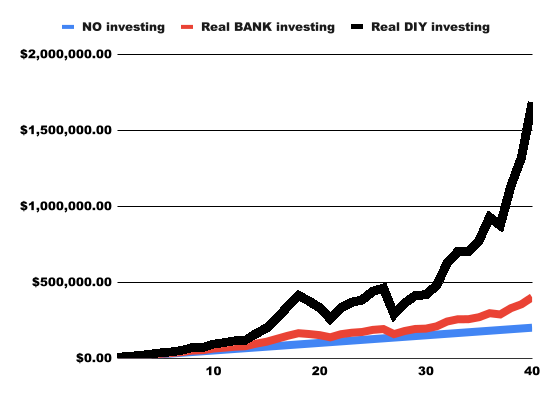

In reality, there is uncertainty so whenever you invest you will encounter volatility, meaning it is not a smooth ride. The last 40 years looked like this:

As you can see, in the last 40 years Beth outperformed Tobias eightfold. While Jason investing through his bank made only one fourth of the fortune amassed by Beth. So how did she do it? You will be able to do it too by the end of the post.

Once you are aware of this it’s hard to stay there and watch without doing anything. Luckily changing your course of action isn’t hard at all. So the right question should be:

How should I invest better?

It is much simpler than one might think. Thanks to new technologies, dedicating a little time to it when you are young is enough to make a significant impact in your life. The older you are, the less valuable these notions will be unfortunately. First of all, you need to

- get an overview of the various investment alternatives.

- know some basic notions.

- and think for yourself.

There is a lot of interest from various parties to create as much disinformation as possible on this issue. The world is full of charlatans with magical ways to make money, but we don’t live in Hogwarts, so these people should be shunned.

What are your alternatives?

Unfortunately you have a lot of them. On one hand, a wider choice is better, on the other it paralyses decisions and leads to that insecurity that lets you to think that you cannot make it alone… But worry not! Every great investor was in your shoes once.

Here I list all the categories (or “asset classes” if you want sound cool) in which you can invest with a brief description. Each has its pros and cons and becomes more attractive based on the context (historical moment, investment objectives, age, geography, risk appetite, amount of capital, tax incentives, etc.).

_stocks

Stocks or shares are pieces of all those companies meeting the minimum requirements in terms of size and clarity to be listed on a stock exchange.

Owning them does not guarantee certain returns as in the case of bonds, but on average they were historically higher. Some shares of mature companies may even issue dividends. Stocks are often liquid investments, meaning they are easy to trade.

Specific companies can also go bankrupt so selecting them well is essential! It is advisable to know an industry well and focus there or diversify altogether.

To get a good diversification at lower costs this is where funds come into play:

- there are actively-managed ones, often with very high costs of even 2 or 3% per year plus ancillary charges.

- and there are those with passive management, called exchange trade funds (ETF in brief), that automatically replicate indices and cost very little, often under 0.5% commissions. In this guide, I will delve more into these ones.

_currencies (a.k.a. FOREX)

All that currencies such as EUR, USD, YEN, etc. To be precise it would be better to address them as “FIAT” currencies. They always have a central body as a counterpart such as the ECB or the Fed.

The more these currencies are used, the more power the central banks have and the more stable they are (check hyperinflation and Venezuelan Bolivares to see when it goes bonkers). If you’d like to trade in FOREX, bear in mind that currencies are exchanged and profits are made by seeking arbitrage, often on cents or thousandths. Large capitals and a lot of monitoring are needed to achieve these arbitrages.

Sometimes you can take advantage of sudden swings, for instance: at the beginning of COVID, EUR 1 has changed in value within a month from BRL 4.50 to BRL 6.50 (Brazilian Real). In those months, buying a house in Brazil costed 40% less for those who owned EURO and were physically there. Prices have now adjusted; smart Brazilians started pinning real estate prices to US Dollars, a more stable currency.

Moreover, consider that central banks print money every day and use such money to finance indebted states and companies that are large or have strategic value. Myth debunked: “printed money” often DOES NOT impact our lives and our savings because that excess liquidity almost never pours into the real economy.

_cryptocurrencies

They are very trendy lately and there are thousands of them, they all look different, but in the end they are all highly correlated with the price movements of Bitcoin (BTC). A diversification could only makes sense if you wanted to try and guess which one cryptocurrency will become the most “chat” next month.

We must be wary of blockchain technicians talking about digital infrastructures, more efficient systems, etc. As in currencies, it only matters how much they are considered by the crowd. You should NEVER invest all your capital in one cryptocurrency, they often ended up being scams; a small minority is legit.

_bonds

All debt instruments. If you become the owner of a Treasury Bill or a German Bund, you are a creditor of a State. Insurance companies and banks buy them in large volumes to have more negotiating power with the State. For small investors, apart from the beauty of flaunting it at the bar with friends, there is little else nowadays.

When a safe institution that cannot fail issues the bond, it is called “risk free”. In this case, income is guaranteed but it is very low and sometimes even negative, meaning you are certain to lose money. There are also other debtors such as companies, individuals, etc. If it is issued by a dodgy company or government (i.e. Argentina) that can fail any time, it is called “junk bond”. In the past they had good income, but today they are a joke. Bonds are inevitable to avoid if you invest through banks or other intermediaries, keep this in mind.

*2023 update: some bonds are becoming attractive again, as I am writing, US Treasuries are yielding a safe 4 to 5% risk free this year. Check them out. Keep in mind that the USD is losing value very quickly against other major currencies like EUR, so it may offset the returns.

_retirement plans

Several tax advantages make these plans very appealing. You will incur in penalties if you withdraw your money earlier. It is way harder to encounter swindlers in retirement plans comparing to banks. Depending on your country, you may even be able to invest in ETF through such plans. Keep in mind that operating directly on the markets your choice will be much wider.

Often your employer will add some contributions if you decide to adhere to a retirement plan; I recommend using them to maximize the contribution you receive from your employer.

_insurance

With insurance you will never become a millionaire, but it is useful to overcome the opposite problem: misery. Every company offers a different insurance policy and it is always better to compare. Some provide a redemption of the accumulated capital, meaning you can request your money back.

More than an economic investment, insurance offers great returns in terms of peace of mind.

_derivatives

Derivatives are the Pandora’s box of crap and include options, forward contracts, short selling, etc. Here are you find the most extreme (and often immoral) gambles. However, while with all forms of investing you can lose at most what you have invested, many of these instruments can also go into the negative.

Some options help mitigating risk and can be useful IF complementary to other forms of investment (see married put). In general, they require many hours and knowledge and allow you to move large capital through leverage, BUT you don’t sleep well at night.

_real estate

As for home ownership, geography and physical presence are crucial in the selection and purchase of the property. It can be a profitable investment based on the area and type of use. When interest rates are lower than inflation, it is essential to take advantage of fixed rate mortgages and leverage as much as possible. It is not a very liquid market and the selling and buying times are long.

On the other hand you can also invest in real estate investment trusts (a.k.a. REIT). These are shares issued by companies that owns and groups various properties with the same type of use and/or the same area geographic. The advantage is that they cost less than a house, are diversified and are easier to trade; the disadvantage is that you cannot live inside a REIT.

_private equity

With private equity, you become shareholder in all those companies that are not listed in the stock market because they are either too small or do not conform to the various bureaucratic requirements required to be listed.

Very little information is available to us simpletons so you have to trust the decision makers of the private equity fund. They often have to move important capital and get to know the management team personally or even take over the management themselves. These funds make money in 2 ways:

- buy dying businesses to dismember them and resell the single assets with a surplus (a.k.a. vulture funds).

- buy inefficient businesses, restructure them and resell them.

If you have your own company and you are the owner, you are doing some kind of private equity. Even if you make more than 10% of what you put into it, other forms of investing can still help you spread the risks.

_commodities

For example, steel, oil, wheat, gold, etc. They are all those assets with a fixed and established market value. In these products there is little differentiation and retail prices differ very little from the market value. Some commodities, for instance pork meat and wheat, undergo cyclical seasonal variations.

In general, their prices raise dramatically during inflation periods. A couple of words on gold: it’s considered a safe haven asset because in the past it has always moved in the opposite direction when markets were in crisis; it also holds a strong symbolic value.

Investing in commodities certainly has a value but apart from precious metals I have not enough knowledge to give advice on the matter. If you are a pragmatic person or work in the primary sector, I advice to study commodities familiar to you and their surrounding businesses.

_other investments

These are entire worlds in and of themselves and require very specific passions.

You have often heard that cars are the worst investment, but it could also be nonsensical advice. If having a car allows you to reach places and do things that you could not do before, or gives you access to opportunities that you did not have, the investment is more than justified. It is always better to buy them used unless you have the skills to recognize and restore a vintage car whose value could also increase over time.

A replica of Marcel Duchamp’s “Fountain” artwork could be much more rewarding than a vintage car; it goes without saying that if you don’t have such passion, it’s easy to make enormous mistakes. I dislike this sentence but in this case, “you should follow your passion.”

How do I choose?

It depends on your needs, your goals and how much time you are willing to devote to them. In any case, the advantages are enormous thanks to compound interest. Everything is faster and easier if you apply the rule #1 shown at the beginning of the guide with small amounts you can afford to lose.

In making the choice, having specific industry knowledge helps a lot. Just remember to either manage your investments independently or contact intermediaries and/or consultants without conflicts of interest.

Whatever you choose, you will always run a risk. Diversification significantly reduces such risks and, in case of ETFs, you also spend less.

How should I start?

Putting in some real money and starting with small sums. Absolutely avoid being a perfectionist or wanting to know everything before starting, nobody knows everything and you need to learn to be comfortable with uncertainty.

Getting in as early as possible is often the best way to learn quickly and minimize regrets.

Very often the right insights are the obvious topics that pop up in a pub conversation like,

- “Alas, this covid-19 thingy seems really serious, these pharma companies will get awfully-rich with vaccines, maaan.”

- “Did you see that the oil deals have been upset? There was a collapse in oil barrel prices. Shite! Dreadful gasoline keeps costing the same though…”

- “When they starts shooting these first rockets on that golden asteroid, see how everyone will fear the decline of gold prices. Bitcoin to the moon, maaan”

The difference between someone with remorse and the guy who makes money is just hitting the “buy” button after one of these mundane conversations.

Selecting an ETF is easier comparing to a stock. At the beginning you should learn to select ETFs on important indices. Then progressively, if you’d like to spice it up a little, start putting small portions of your portfolio in to specific stocks.

How do I choose an ETF?

A great classic is the S&P 500 which includes the top 500 companies in the USA. ETFs can be classified according to geographical areas (i.e. Greece, China, emerging countries, etc.) or by sectors (i.e. automation, biotechnology, cannabis, etc.).

All the extra additions to the title of the ETF such as “momentum factor” are paraphrases to raise commissions. You can always see the commissions from the specific KIID document (it is required by law); if they are below 0.5% it might be a good one. The best ETFs usually can get even under 0.20% commissions.

ETFs help to protect you against your own ignorance so they should make up a large part of your investments at least initially. In general, ETFs are stable and have historically yielded good growth over time, averaging 7/8% for the S&P500 over the past 70 years with 1 year of crisis every 3 good years.

If you want to sell and there is a crisis, you wait a few years for the price to rise and then sell. ETFs do not swing as much as single stocks and do not offer particularly-intense emotions, but in the long term, thanks to compound interest, they will give you great satisfaction.

ETF allow you to spread your risks over a huge amount of different companies without having you to buy each one of them. However, if you are really into minimizing risks, you can step it up a notch by spreading your risk over time. Instead of buying everything in one chunk, spread your purchases over the months.

How do I choose a stock?

I would recommend you to start by buying shares of brands that you love and use often. Strong brands thrive.

Single stocks should occupy a small part of the portfolio compared to ETFs. Just to give you an idea, now I hold 60% in ETFs, 35% in stocks and 5% in cryptocurrencies. However, when I have started it was 100% ETFs.

However the less time you want to spend on this the better you keep almost the

entirety in ETFs. Companies need to be monitored more often they take longer to select. They can swing a lot, and if they file for bankruptcy you lose everything, if you remember NOKIA and KODAK you know what I mean.

Some stocks can be the golden nugget that change your life, especially “small caps” (with market capitalization below 2 billion). The smaller a company is, the more it can grow in percentage. Small caps working on covid19 vaccines in 2020 have quietly achieved a +300%.

In the short term, the market tends to overestimate or underestimate shares based on the mood, but remember that a stock always underlies a real enterprise. Even if the value varies over time, in the long term the price has a tendency to lean on how well this company forges a strong brand and provides quality products and services. For this reason you must buy when undervalued and sell when overvalued. It seems obvious, but your beginner emotions will force you to do vice versa and question your choices.

Should I use a method? Which one?

I am sure you have tried at least once in your life to alter your body through a diet like Paleo or Keto just to find out you just need to count calories and nutrients and you will succeed with most foods. Investing methods are the same as diets! Just learn the basics and stick to them.

There is no magic method unfortunately, over time you will develop a sensitivity based on how much you are interested in making money through the markets. In general, the important thing is to dedicate the right time to a decision regarding the allocation of a sum that you consider “large.”

Like the disclaimer in a pack of cigarettes, etoro tells us that 75% of users lose money. They lose because they trade continuously and get scared as soon as the market goes red for a moment; these users are called “weak hands”. If you choose something with some decent criteria and stick with it for at least a few months, ideally years, you are unlikely to experience silly mistakes.

If you expect a crisis, it is desirable to keep a small amount of cash to be ready to buy when everything collapses. Don’t hold everything in cash because any crisis may also arrive in 5 to 10 years and you can easily miss the growth!

Charts, analyst views, and toy models are all rigmarole to add complexity, barriers and jobs to this industry that doesn’t need them. For your personal knowledge, I quote you the most used methods with their respective pros and cons:

feel entitled to skip this if you don’t give a shit

_technical analysis

This method is based only on the analysis of price charts, it is widely used and sometimes it self-fulfills its predictions precisely because so many use it and believe it like a sort of religion. They don’t care if the company is almost bankrupt; if the price chart makes a “camel”, a “dead cat jump” or a “head & shoulders” figure they dig in.

In my opinion it is a waste of time, it can make sense in the short term when you have to sell well a stock on which you were speculating or with cryptocurrencies, for which, apart from the price, you do not have large references. You can always find excited kids on YouTube doing these analyses for free.

_fundamental analysis

This is based on crunching numbers, meaning balance sheets, data, sales, dividends, leverage, etc. Basically all data relating to the health of the underlying business in order to derive a fair market value or fair value. These fair values vary greatly according to the assessment methods used.

In general, looking at this data can be a good initial filter to identify scams immediately, but it is not the final solution that will allow you to make millions. In the long run, it’s definitely better than the method mentioned above. You can find excited kids on YouTube for these analyses too.

The evolution of this is Buffett & Munger’s latticework of mental models where a company must make sense according to about eighty mental models taken from various disciplines before being considered attractive to them (for further information, “Seeking Wisdom” by Peter Bevelin or “Poor Charlie’s Almanack” by Charlie Munger). This is advanced stuff that takes time, just skip it for now.

_behavioral finance

This approach is the relatively youngest one, yet the one that makes more sense. In short, it says, “What is the market if not a group of fools that buy and sell? What will most of these fools do? What kind of fools do invest in company X? How will these different groups of clowns behave?“

In short, here you try to predict the movements of the flock before they actually happen. We need to know how the technical guys think, how fundamental guys think, how banks and funds think and make decisions, we need to know the cognitive bias of human beings.

This is the most comprehensive approach that exists and if you do the calculations correctly and take your calculated risks, it can give you great emotions. For instance, just take a look at the Due Diligence (DD) of the user FatAspirations on r/Wallstreetbets (for more information, read “Predictably Irrational” by Dan Ariely).

What news should I read?

None.

Many newspapers write what their financers tell them to write, reporting summary or even incorrect data. With the internet the number of fools thirsty for clicks who give biased opinions has skyrocketed. This problem is addressed as conflicts of interest and it’s one of the most important concepts you should be aware about.

Even news from the most renowned sources is useless because by the time you read it, it’s often already too late to act. If you are already holding stocks, you can read news to rationalize a sudden price movement. Other than that they are useless.

It is much more useful to know a sector well and participate in trade fairs. Follow the economic macro-trends (check the YouTube channel “Heresy Financial”).

It can be useful to peek at the official statements of the companies themselves. Sometimes there are professionals selling you junk making allegations that the companies themselves have never declared.

What are conflicts of interest?

All these situations where your interests and those of the guy who should help you are not aligned.

Charlatans will make you believe that they know better than you since they have years of experience and some sort of clairvoyance. They are sellers paid by someone who has interest in placing you mediocre products full of commissions.

In actively-managed funds there are often also very risky bonds that yield very little. Why? Of course conflicts of interest! For instance, some banks would easily lend some of your money to an edgy entrepreneur at low rates. This allows them to force the indebted entrepreneur to use such banks for all their complimentary services. You get low rates and high insolvency risks while the bank gets more business.

The sneakiest thing is to pack this crap into funds and confuse the clients with colored graphics and incomprehensible acronyms. Unfortunately this is common practice now.

NOBODY can predict the future. EVERYONE can predict their costs and their commissions with a minimum of reading.

Furthermore, it has been shown that passively-managed funds (ETF) beat the vast majority of funds managed by “professionals” within 10 years. This outcome does not even take into account the expenses related to these professionals.

Having said so, investment professionals are not all rotten apples. Just make sure their interests are aligned with yours. They should have their own money invested in what they want to sell you. Alternatively, they should be an independent consultant paid by you.

How to avoid conflicts of interest?

By acting independently, thinking for yourself and buying the assets directly. Nowadays it is possible to use brokerage platforms to buy and sell independently. These platforms should have the following requirements.

- low costs.

- aligned interests.

- be an Electronic Communications Network (ECN) and NOT a market maker. It means the broker cannot manipulate prices but must only report them.

- transparency.

- wide choice.

- true underlying assets (not a CFD).

- guarantees on custody.

- opportunity to act quickly.

- great plus if they also offer you some help in tax reporting.

For these reasons I personally use DEGIRO, but if you find a better alternative with the above features, feel free to choose that (check brokerchooser.com). If you don’t want to do it, find an independent financial advisor paid entirely by you who does serve your best interests.

Why do costs matter?

There is nothing wrong to pay for a product or an activity that brings you value. Very few investment managers bring added value comparing to going solo, let me explain.

Investment managers follow the market and diversify a lot. In the event an investment manager reasons with her/his own head and “dares” to leave the pack:

- Scenario 1. She/he beats the market several years in a row and becomes a pop star.

- Scenario 2. She/he is wrong and the next day she/he is done working.

Banks and funds are made up of groups of people who have no incentive to think and dare to act differently, quite the contrary actually.

Working with banks and active funds, you would pay something from 2% to 3% plus ancillary charges. You would have at most the same diversification that you would already find in an ETF which often costs less than 0.5% per year.

These percentages seem low but just look at this table to see how this trivial choice compounds and burns your capital over decades.

| Years | 0.5% | 1.0% | 1.5% | 2.0% | 2.5% | 3.0% |

| 5 | -2% | -5% | -7% | -10% | -12% | -14% |

| 10 | -5% | -10% | -14% | -18% | -22% | -26% |

| 15 | -7% | -14% | -20% | -26% | -32% | -37% |

| 20 | -10% | -18% | -26% | -33% | -40% | -46% |

| 25 | -12% | -22% | -31% | -40% | -47% | -53% |

| 30 | -14% | -26% | -36% | -45% | -53% | -60% |

| 35 | -16% | -30% | -41% | -51% | -59% | -66% |

| 40 | -18% | -33% | -45% | -55% | -64% | -70% |

| 45 | -20% | -36% | -49% | -60% | -68% | -75% |

| 50 | -22% | -39% | -53% | -64% | -72% | -78% |

Now I cannot invest. I will invest when I earn more.

Sounds familiar?

Everyone can and should invest right now. Set aside at least 10% of your salary every month immediately when you receive it. If you cannot, check your expenses or change job (read and let your children read “The richest man in Babylon”).

Time is the most important resource of an investor. Start compounding earlier.

According to the book “The Millionaire Next Door”, even a janitor who earned less than USD 1,000 became a millionaire thanks to consistent investment practices.

As in diets, if you want to lose weight you have to reduce the consumption of calories; if you want to invest, you don’t have to get overwhelmed by the euphoria and increase your standard of living as soon as you get a raise.

Always live below your means. The people who judge you for your crappy car and your crappy clothes won’t be there to financially support you when you are broke.

Your salary is below the minimum wage? Be creative, live in a hostel, get a tent, volunteer for a roof, find a bum shelter, etc. Build it up from there.

I recommend you to start monitoring your expenses and planning your budgets often. Trust me, wonders await you.

Do I need to pay taxes? How?

Yes, you must pay taxes based on your tax residence during the year in which you SELL the assets. For instance, in Ireland the capital gain tax is 33%. So if you invest 100 and sell at 200, you earn 67 and owe 33 in taxes.

Some capital losses can be deducted from capital gains to reduce taxation.

There are worse rates (see 42% in Denmark) and there are also much better (almost 0% in Switzerland, Hong Kong and Malaysia).

Furthermore, the declarative regime allows you to pay the capital gain taxes of 2022 when you declare them at the end of 2023.

If you sell often you will pay taxes more often and your capital will be eroded quickly. The logical conclusion is to choose wisely and hold as long as you can.

Finally, it is clear that, *assuming that today’s taxation remains in force, if you move to Switzerland at the age of 60 you will not pay any tax even if you have bought and held shares in your home country for a lifetime.

Note: Even if you do not sell any assets, you may have to file the tax report for monitoring purposes. Inform yourself accordingly.

How can I reduce risks?

Returns do not exist without risk; they are the yin and the yang. However, a riskier asset does not necessarily imply more returns. In general, risk is perceived by everyone as a negative thing, but in finance it is more of a neutral concept.

What does finance mean with risk? Nothing, the risk expresses how much the capital can vary over a period of time. Just showing you a couple of examples:

- If you bought Amazon stocks in the early 2000s and you are now a millionaire, you made a “very risky” investment because it has grown very quickly.

- If, on the other hand, you have invested in Italian Treasury Bills and achieved a sure -0.75% return, your investment was risk free.

Now do you understand how lazy it is to avoid investments just because they are “risky”? In the beginning, when you are young and the capital you start from is low, it is desirable to take more risk.

In most countries your intermediary needs you to answer a questionnaire about your investment knowledge in order to allow you to trade. Bankers often fill it for you so they can give you the worst crap. On trading platforms you get to fill it on your own. It is also a great way to learn about financial products.

It is important to differentiate between good risk (upside risk) and bad risk (downside risk). With time and experience you will improve your sensitivity and learn to weight risks and returns better.

Brief practical recap

Now that you are aware of the basics, let’s recap the steps:

- Open a brokerage platform account on your name.

- Deposit some funds on it.

- Take a questionnaire to gauge your investment knowledge. You should be able to pass it easily after reading this guide.

- Choose an ETF based on macro-trends and commissions on the KIID.

- Click the “buy” button on your trading platform.

- Hold it. Love other humans in the meantime.

- File tax reports yearly and pay taxes (if required).

The End.

Something unclear? Comment below.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Heya i抦 for the primary time here. I came across this board and I in finding It truly helpful & it helped me out much. I am hoping to give something again and aid others such as you aided me.

Hello, happy to read that. I believe this stuff should be taught at school. Earn a lot and spread love.

I and my friends were going through the nice, helpful tips from the blog then the sudden came up with an awful suspicion I never expressed respect to the website owner for those secrets.

Hi Shawn, happy you guys found value in it. All the best for your investments.